Victoria Asset Management is an integrated real estate

asset management business, focused

on delivering superior asset management services for

capital invested by Oaktree Capital Management

Victoria Asset Management is an integrated real estate

asset management business, focused

on delivering superior asset management services for

capital invested by Oaktree Capital Management

Victoria Asset Management is an integrated real estate

asset management business, focused

on delivering superior asset management services for

capital invested by Oaktree Capital Management

Victoria Asset Management is an integrated real estate

asset management business, focused

on delivering superior asset management services for

capital invested by Oaktree Capital Management

Victoria Asset Management

Victoria Asset Management is an integrated real estate asset management business, focused on delivering superior asset management services for capital invested by Oaktree Capital Management. Victoria Asset Management supports Oaktree Capital Management in the underwriting and management of investments across the capital structure in all commercial real estate asset classes; ranging from non-performing loan investments, direct assets and preferred equity interests, corporate restructures and structured finance opportunities.

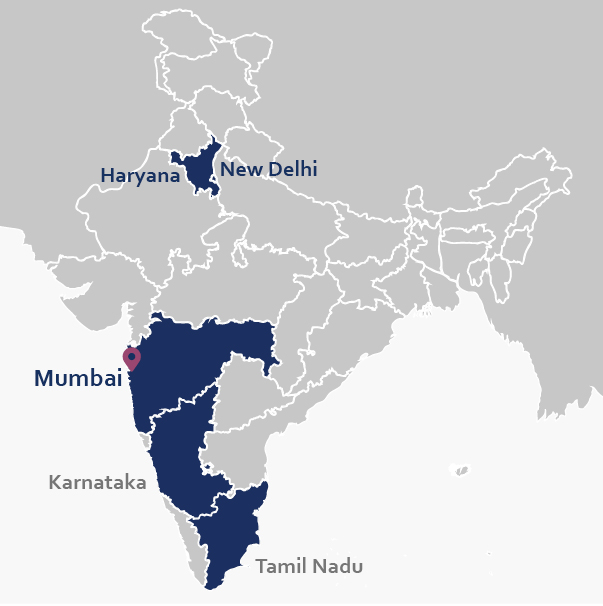

Victoria Asset Managment Offices

Managed Investments

Victoria Asset Management was initially established in 2012 with a focus on the underwriting and management of non-performing loan investments in Europe on behalf of funds managed by Oaktree Capital Management, L.P. The business has subsequently evolved to span all real estate asset classes and to support Oaktree in its investments across the capital structure.

Since inception Victoria Asset Management has helped Oaktree to close over €7.6 billion of investments on behalf of Oaktree across all real estate classes and levels of the capital stack.

Central functions are located in London with dedicated investment professionals across regional offices in Madrid, Shanghai, Hong Kong and Mumbai. The 47 strong team focuses on delivering acquisitions, real estate management, loan management, tax structuring, financing and portfolio management services.

Victoria Asset Management is authorized and regulated in the United Kingdom by the FCA.

Victoria Asset Management applies an integrated, multi-disciplinary approach in delivering support services for Oaktree’s investments.

Managed Investments*

Non-Performing Loans (NPLs) €517.2m

Equity/Direct Assets €3,184.3m

Structured Debt €3,917m

*As at April 2024

Our Services

Victoria Asset Management provides the following services to Oaktree:

Investment Origination

Investment Underwriting

Portfolio Reporting

Asset Management

Transaction Management

Our Culture

Our Purpose

To drive investment performance through innovation and a multidisciplined approach.

Our Approach

Strategic

Detail Orientated

Incisive

Innovative

Integrated

Streamlined

Our Values

We are value driven

- Focused on efficiency

- Delivering value added services and high levels of client service

We work collaboratively

- Collaboration is inherent in our company’s culture

- We adopt a multidisciplined approach to harness our collective expertise

We value our people

- We respect and value our team member's contributions

- We actively encourage career growth

- We take responsibility for our people

We are dynamic

- We foster positivity, creativity and a progressive mindset

- We respond and adapt quickly to new information or events

We are astute

- We use our commercial intellect and extensive experience to add value at every stage

- We manage risks whilst optimising returns

- We articulate clearly

We act with integrity

- We are professional, honest and fair

- We build trusting, long-term relationships

Contact us

United Kingdom

Verde, 5 th Floor

10 Bressenden Place

London SW1E 5DH

Tel: +44 (0) 20 7429 2299

Spain

Paseo de la Castellana 15, 2A

28046-Madrid

Spain

Tel: +34 910210462

Hong Kong

Suite 6113, 61/F Two IFC

8 Finance Street

Central Hong Kong

Tel: +852 2158 9185

India

103-A, 10th Floor, 3 North Avenue

Maker Maxity

Bandra Kurla Complex

Bandra East, Mumbai – 400051

Tel: +91 22 69514360

Shanghai

Suite 06B, 17/F 1788 Square

1788 West Nanjing Road

Jingan District, Shanghai, 200040

P.R. China

-

Privacy Policy

VicAsset Advisors UK Limited and its affiliates are committed to protecting and respecting your privacy. This Policy explains how your personal information is processed by the VicAsset affiliates listed in the Data Controllers and Contact section below (“VicAsset”, “us”, or “we”). It also tells you how you can access and update your personal information and make certain choices about how your personal information is used by us.

This Policy covers personal information we collect through our websites at www.vicasset.com and our SharePoint environment (the "Sites") as well as in connection with our valuation, workout and servicing of loans and other asset management related services carried out on behalf of certain funds managed by Oaktree Capital Management, L.P. (“Oaktree”) and other customers.

It also explains how we collect information through the use of cookies and related technologies on our Site. Certain sections may not be applicable to you depending on how your personal information is provided to us.

We may also provide additional information about our privacy practices at other points – for example when we provide services to new borrowers as part of a new loan portfolio acquisition – and where this will help mean we can provide more relevant and timely information.

Information we may collect about you

We may collect and process the following information:

Site visitors

- Contact information such as your name, email address or login ID when you access or make an enquiry on our Sites; and

- Information automatically collected from your use of our Sites such as technical information, including the Internet protocol (IP) address used to connect your computer to the Internet, browser type and version, time zone setting, browser plug-in types and versions, operating system and platform and information about your visit (such as clickstream data, pages you interact with and lengths of visits to certain pages). Some of this information may be collected by cookies or other technologies (see below for more details).

Vendors, operating partners and other service providers

- Contact information such as name, address, position, organization, email address and phone number;

- Financial details (for invoicing and billing purposes); and

- KYC due diligence information on directors or beneficial owners (where required to meet specific anti money laundering, counter terrorism financing and anti-bribery legislation).

Persons connected with investments

As part of the services that we provide to our customers, we will process personal information about relevant persons connected with the Investments (such as borrowers, guarantors or tenants). This comes from a number of sources, including the vendors of the relevant assets during the acquisition process, from you directly or from our customers and other affiliates, agents, delegates (including special service providers and sub-service providers), professional advisors or third-party financiers or carrying out checks using publicly or commercially available sources. We will ensure that these searches are proportionate to the purposes outlined below. Your personal information may be combined from these different sources for the purposes outlined below.

- Contact information such as your name, address, position, organization, email address and phone number;

- Date of birth, nationality and the amounts outstanding under a loan (or other financial instrument), and the previous performance of the loan as well as related documentation and correspondence;

- Information relating to your financial circumstances such as the nature of your profession or business, your income, assets and liabilities as well as sensitive data such as criminal records, and political affiliations. This may include information about other relevant persons connected with the Investment (for instance, we may process information about your family, guarantors or sponsors in respect of personal guarantees in order to establish your net worth or information about tenants to establish the value of relevant properties).

If you provide information to us about any person other than yourself, you must ensure that they understand how their information will be used, and that they have given their permission for you to disclose it to us for the purposes outlined in this Policy.

We do not knowingly process any personal information about anyone under the age of 18.

Purposes and legal basis of processing

We use your personal information in the following ways, relying on the following lawful grounds:

Website visitors

In accordance with our legitimate interests (when these interests are not overridden by your data protection rights):

- to send service related communications and to respond to your enquiries;

- to administer, maintain and improve our Site and services; and

- for internal operations, including troubleshooting, data analysis, testing, research, statistical and survey purposes.

Vendors, operating partners and other service providers

- to carry out our obligations arising from any contracts entered into between you and us and to facilitate the provision or receipt of services;

- to maintain internal records and to communicate for business purposes; or

- to comply with any relevant legal or regulatory obligations (e.g. to meet specific anti money laundering or counter terrorism financing requirements).

Persons connected with investments

- in accordance with our legitimate interests, to manage and administer your loan (including your ability to repay the loan and to determine the appropriate strategy) and any related guarantee(s) or security including the collection of the debt owed by you;

- to comply with any relevant legal or regulatory obligations (e.g. to meet specific anti money laundering or counter terrorism financing requirements);

- where the processing is necessary for reasons of substantial public interest on the basis of relevant laws; or

- where the personal information has been manifestly made public by the individual.

We may also use your personal information in other ways for which we will provide specific notice and/or obtain your consent (where required) at the time of processing.

Disclosure of your information

- We may share your personal information with the following recipients for the purposes outlined above:

- other affiliates within our group (including Oaktree and its investment funds). You can see more about our affiliates at https://www.oaktreecapital.com/;

- our Operating Partners (including special service providers and sub-service providers), purchasers, asset managers, professional advisors and third-party financiers connected with a particular loan portfolio;

- any law enforcement agency, court, regulator, government authority or other third party where in our reasonable opinion this is necessary to comply with a legal or regulatory obligation or otherwise to enforce or apply our terms of service, loan arrangements or other contractual obligations; or to protect the rights, property and safety of VicAsset or its affiliates, our clients and others. This includes exchanging information with other companies and organisations for the purposes of the prevention or detection of financial crime including fraud, money laundering and terrorist financing;

- prospective or eventual buyers of our business (if we or substantially all our assets are acquired by or merged with a third party);

- trusted third party service providers who perform services on our behalf or on behalf of Oaktree. These parties can only use your personal information as necessary to perform the relevant services or to comply with legal requirements. Examples of these parties include Primary Servicers, organisations that provide website hosting.

Where we store your personal information

The personal information you provide through our Sites is stored on servers in Ireland and Amsterdam and supported from London and New York.

We may also transfer other personal information we hold about you to our affiliates and service providers acting on our behalf which are based outside of the European Economic Area, including in the US and India. Where this is the case, we will take steps to ensure that your personal information is adequately protected either by European Commission approved standard contractual clauses, an appropriate Privacy Shield certification or through binding corporate rules. A copy of the relevant mechanism can be obtained for your review upon request to us using the contact details below.

We take reasonable steps to protect your personal information from unauthorised or unlawful processing and against accidental loss, damage or destruction. For example, we have contractual arrangements in place with organisations which process your personal information, and all information you provide to us is stored on our secure servers.

Unfortunately, the transmission of information via the internet is not completely secure. Although we will do our best to protect your personal information, we cannot guarantee the security of your information transmitted to our Site; any transmission is at your own risk.

Information about our use of cookies

A cookie is a small file of letters and numbers that we store on your browser or the hard drive of your computer if you agree. Cookies contain information that is transferred to your computer's hard drive.

Our Sites uses essential cookies that are required for the operation of our Sites. They include for example cookies that identify you once you have logged in (e.g. to our SharePoint site) to enable you to gain access to authorized content. These cookies are session cookies and will be deleted from your device once your session is terminated.

You can block cookies by activating the setting on your browser that allows you to refuse the setting of all or some cookies. However, if you use your browser settings to block all cookies (including essential cookies) you may not be able to access all or parts of our site.

Your rights

You have various rights with respect to our use of your personal information:

- Access: You have the right to request a copy of the personal information that we hold about you.

- Accuracy: We aim to keep your information accurate, current, and complete. Please let us know if any of your personal information is not accurate or changes, so that we can keep your personal information up-to-date.

- Objecting: In certain circumstances, you also have the right to object to processing of your personal information (including for marketing and profiling purposes) and to ask us to rectify, block, erase and restrict your personal information.

- Porting: You may have the right to request that your personal information is ported to you or another data controller.

- Complaints: If you believe that your data protection rights may have been breached, you have the right to lodge a complaint to the applicable supervisory authority or to seek a remedy through the courts.

Please note that there are exceptions to all these rights: for example, access may be denied if making the information available to you would reveal personal information about another person or if we are legally prevented from disclosing such information. If you wish to exercise any of these rights, please contact us using the contact details below.

When we ask you to supply us with information we will make it clear whether the information we are asking for must be supplied so that we can provide the products and services to you, or whether the supply of any information we ask for is optional.

How long we keep your personal information for

We will retain your personal information for as long as we believe it necessary or desirable to fulfil our business purposes or to comply with applicable law, audit requirements, regulatory requests or orders from competent courts. For more information, please contact us, using the contact information below.

Changes to our policy

We reserve the right to make changes to our practices and Policy at any time. If we change the way we handle your personal information, we will update this Policy and notify you as and when appropriate, usually by way of placing an updated Policy on our Site. If we make significant changes that materially alter out privacy practices, we may also notify you by other means, such as sending an email prior to the change.

Data and controllers and contact

Questions, comments and requests regarding this Policy are welcomed and should be addressed to privacy@vicasset.com or sent to the address below. For the purpose of applicable data protection law and this Policy, the relevant data controllers are:

Data Controller

Responsible For

VicAsset Advisors LLC (a Company incorporated in Delaware) whose registered address is Oaktree Capital Management LP, 333 S Grand Ave Ste 4050, Los Angeles, CA 90071-1561

Oversight of the corporate activities of VicAsset Advisors UK Limited and provision of Special and Master Servicing activities for its Customer(s)

VicAsset Advisors UK Limited (Company Number 08003325) whose registered address is Verde, 10 Bressenden Place, 5th Floor, London, SW1E 5DH

All activities where VicAsset Advisors LLC has delegated certain aspects of its Special or Master Servicing activities

VicAsset Advisors Spain SLU (Company Number B87266433) whose registered address is Calle Nanclares de Oca, 1B, 28022 Madrid, Spain

Provision of real estate advisory services as well as certain Special or Master Servicing activities which have been delegated by VicAsset Advisors UK Limited

VicAsset Advisors Germany Gmbh (Company Number HRB 103556) whose registered address is Wirtschaftsprüfungsgesellschaft, Ulmenstraße 22, 60325 Frankfurt am Main, Germany

Provision of real estate advisory services as well as certain Special or Master Servicing activities which have been delegated by VicAsset Advisors UK Limited

VicAsset Advisors Hong Kong Limited (Company Number 2806213) whose registered address is c/o Intertrust Hong Kong Limited,3806 Central Plaza, 18 Harbour Road,Wanchai, Hong Kong

Provision of real estate advisory services as well as certain Special or Master Servicing activities which have been delegated by VicAsset Advisors UK Limited

VicAsset Advisors India Private Limited (Corporate Identity Number U74999HR2020FTC086603) whose registered address is B-583, Adjacent Park Plaza, Gurgaon IN, Sushant Lok, PH-1, Gurugram, Gurgaon, Haryana, 122009, India

Provision of real estate advisory services as well as certain Special or Master Servicing activities which have been delegated by VicAsset Advisors UK Limited

-

Employee Privacy Notice

What does this notice cover?

This notice describes how VicAsset Advisors UK Limited and its affiliates (‘the Company”, "we", "us") use and disclose your personal data as part of your potential, current or previous employment relationship with us. We also may provide you with additional information when we collect personal data where we feel it would be helpful to provide relevant and timely information.

This notice applies to Company employees and, where applicable, to contractors who provide services to the Company. The data processing described in this notice may be limited as required by applicable law.

What personal data do we collect?

We collect and process personal data about you. This includes, where permitted by local laws:your name, gender, date of birth, home address, personal email address, personal phone number, employee ID number, work contact details (phone, email, and physical address), nationality, immigration status and copies of identity documentation;

bank account details and national personal ID number for payment and taxation purposes;

beneficiaries’ details in relation to life insurance or other benefits, emergency contacts, marital status, information about family members (name, date of birth, gender and national personal ID number) where necessary for the provision of applicable benefits, guarantees or relocation assistance;

job title, compensation, benefits, professional experience, education and qualifications, training records, skills, expense records (such as details of out of pocket expenses, corporate credit cards, company cars or private cars where an allowance is claimed and mobile phone costs), in certain countries, information about trade union affiliation and religious belief if you have informed us of your trade union membership or asked us to make payments to trade unions or for religious tax on your behalf, information concerning performance history and appraisals, career plans and geographic mobility, conduct and information about violation of laws or breach of company policies, disciplinary proceedings and in certain countries, where permitted, details of professional registrations, and sanctions with professional bodies or criminal convictions where you have consented (as may be required by applicable laws) to a background check;

medical leave information, medical certificates, other documents required to confer special benefit status, such as information concerning pregnancy status and age of children, etc. where applicable;

This includes information processed whilst using our computers, printers, servers and systems (including electronic documents, SharePoint, email, instant messages and internet use), telephones, voicemail systems, other electronic devices used by or allocated to you, desks, lockers, cabinets, vehicles and any other equipment belonging to us together with information collected on CCTV and via other access and security controls (including biometric data) to the extent that this is necessary and permitted by law. For more information on our monitoring activities, please see the Information Security Monitoring Procedure.

Where sensitive personal data is collected, we will ensure that any additional legal requirements are complied with. For example, it may be necessary to ask for your consent in certain circumstances.

On occasion, we may receive personal data from third party sources, such as if we receive details of a certification or training you obtained, or where we receive feedback or references concerning your performance.

How do we use this personal data and what is the legal basis for this use?

We process this personal data for the following purposes:As required to establish and perform the employment contract, to maintain or terminate the employment relationship and to enable you to perform your job. This includes recruiting and hiring and administration of payroll and benefits, establishing your right to work, absence, compensation and taxation, performance and talent management, management, training and leadership development, succession planning, award recognition, employee surveys, marketing, insurance, occupational health, retirement plans, stock plans, expense management and professional travel.

As required to pursue our legitimate interests (provided this is not overridden by the interests or rights of relevant individuals) in particular:

to provide access to our offices, manage our IT systems and infrastructure, collate company directories and provide communication services such as e-mail, telephone and internet access;

to carry out our business functions such as headcount planning, reporting and expense management, quality control and service level verification;

to protect the security of our premises, assets, systems, and intellectual property to administer access rights, monitor and enforce information security and other company policies, including monitoring communications where permitted by local law and in accordance with our Information Security Policy, to conduct necessary investigations and disciplinary actions as well as to monitor Time at Work / absence / flextime etc;

to allow you to access benefits offered by us and other providers. This includes medical insurance, occupational health, retirement plans, stock plans, access to company cars and automotive insurance, and childcare benefits, where provided. Some benefits may require you to provide personal data concerning family members, partners or next of kin, in which case you must inform them before providing it to us;

to connect employees, through the use of internal directories. This includes information which you provide for your internal company profile (including your photo), and for internal communications, permitting the company to share information with employees and allowing employees to identify, exchange information and communicate and work remotely with each other;

Compliance with applicable laws and protection of our legitimate business interests and legal rights, including, but not limited to, use in connection with legal claims, compliance, regulatory, auditing, investigative and disciplinary purposes (including disclosure of such information in connection with legal process or litigation) and other ethics, anti-corruption and compliance reporting tools.

As required by the Company to analyze and monitor the diversity of the workforce in accordance with applicable laws. This includes, for example, compliance with equal opportunity employment laws.

Where permitted by local law and with your consent (as may be required by applicable laws), we may also conduct background checks to evaluate eligibility for employment and medical information if a regular or onboarding health check is required or to evaluate eligibility for applicable benefits.

Who will we share this data with?

Personal data may be transferred to our group companies to administer and manage group functions, including to assess your performance.

Personal data may also be shared with third party service providers, who will process it on our behalf for the purposes above. Such third parties include, but are not limited to, HR & payroll service providers and IT service providers. Personal data may also be shared with third party benefit providers such as travel agencies and travel service providers, banks, credit card companies, brokers, health or life insurance providers, occupational health, pensions providers, medical services and medical insurance providers, training providers, survey service providers, investigators, and employee hotline administrators.

Personal data may be shared with government authorities and/or law enforcement officials if required for the purposes above, if mandated by law or if required for the legal protection of our legitimate interests in compliance with applicable laws.

In the event that our business is sold or integrated with another business, your details may be disclosed to our advisers and any prospective purchaser's adviser and will be passed to the new owners of the business.

Where can you find more information about our handling of your data?

See our fuller Privacy FAQs below for further details on retention periods, data sharing, international transfer, contact details and your rights.Privacy FAQs

What rights do you have in relation to my personal data?

You may be entitled to ask us for a copy of your personal data, and to correct it. These rights may be limited in some situations – for example, where we can demonstrate that we have a legal requirement to process your personal data.Where we require personal data to comply with legal or contractual obligations, then provision of such data is mandatory: if such data is not provided, then we will not be able to manage the employment relationship, or to meet obligations placed on us.In all other cases, provision of requested personal data is optional.

If you have any concerns or questions about how we process your personal data, please contact the Data Privacy Lead at privacy@vicasset.com.

If you have unresolved concerns you also have the right to complain to data protection authorities. The relevant data protection authority will be the supervisory authority in the same country as your employing entity. In the UK, this is the Information Commissioner's Office.

Which entity is your data controller?

The data controller for your personal data is your employing entity i.e either VicAsset Advisors UK Limited, VicAsset Advisors Spain SLU, VicAsset Advisors HK Limited or VicAsset Advisors Germany GmbH as appropriate.How long will you hold my personal data1?

We will keep your personal data (includingdata retained from the application and selection process), for the course of the employment relationship and, to the extent permitted, after termination of employment. Laws may require us to hold certain personal data for specific periods. In other cases, we may retain personal data for an appropriate period after the employment relationship ends to protect ourselves from legal claims, or to administer our business.More information about our retention policies see the Data Retention Policy.1 Read 'Data User' in place of 'Data Controller' for purposes of compliance with Hong Kong data protection laws.

Where will you send my personal data?

Personal data contained in internal directories may be accessed by any of our group companies, including in the US /on a worldwide basis. Other personal data will primarily be processed by employees of the HR, IT and Accounting, Legal and Compliance Teams, where relevant and necessary. Some of these employees and IT systems may be located outside of your country including in the USWhere personal data is transferred outside the EEA, and where this is to a group company or vendor in a country that is not subject to an adequacy decision by the EU Commission, personal data is adequately protected by EU Commission approved standard contractual clauses, an appropriate Privacy Shield certification or Binding Corporate Rules. To find out more information or to obtain a copy of the relevant mechanism for your review, please contact compliance@vicasset.com2.

2 This paragraph is not applicable to Data Subjects in Hong Kong

-

Regulatory Disclosures

VicAsset Advisors UK Limited

Public Disclosure (MIFIDPRU 8)

September 2024

1. Introduction and COntext

The Investment Firms Prudential Regime (IFPR) is the FCA’s new prudential regime for MiFID investment firms which aims to streamline and simplify the prudential requirements for UK investment firms. IFPR came into effect on 1st January 2022, and its provisions apply to VicAsset Advisors UK Limited (“VicAsset” or “the Firm”) as an FCA authorised and regulated firm.

The public disclosure requirements of IFPR are set out in MIFIDPRU 8, replacing the previous Pillar 3 requirements under BIPRU 11.

VicAsset is classified as a non-SNI firm given it breaches at least one of the requirements set out in MIFIDPRU 1.2.1 R to qualify as an SNI firm. In this case, the firm has crossed the following threshold:

- Average AUM, as calculated by the methodology set out in MIFIDPRU 4.7.5 R, of greater than £1.2 billion. Note that in the case of VicAsset, this comprises of assets subject to investment advice of an ongoing nature.

VicAsset is required to disclose the following information:

- Governance arrangements (MIFIDPRU 8.3): non-SNI firms are required to disclose certain information including:

- An overview of the firm’s governance arrangements

- The number of directorships held by each member of the governing body (this only applies to directorships of commercial enterprises, charities and directorships of other group entities are excluded).

- A summary of the firm’s policy on promoting diversity in the governing body.

- Whether the firm has established a risk committee

- Own funds (MIFIDPRU 8.4): firms must provide details of their own funds (using the template provided in MIFIDPRU 8 Annex 1R), and a reconciliation of the same information in the firm’s report and accounts (where available).

- Own funds requirements (MIFIDPRU 8.5): firms must disclose details of their own funds requirements including the fixed overhead requirement (FOR) and a breakdown of their K-factor requirements (non-SNI only). All firms are also required to disclose their approach to assessing their compliance with the overall financial adequacy rule (MIFIDPRU 7.4.7R).

- Risk Management (MIFIDPRU 8.2): firms must disclose their risk management objectives and policies in respect of the following categories of risk addressed by:

- MIFIDPRU 4: Own Funds Requirements

- MIFIDPRU 5: Concentration Risk; and

- MIFIDPRU 6: Liquidity

- Remuneration Policy and practices (MIFIDPRU 8.6)

- Provision of quantitative and qualitative disclosures in respect of the firm’s remuneration arrangements

2. GOVERNANCE

2.1 Overview of Governance Arrangements:

2.1.1. VicAsset Boards

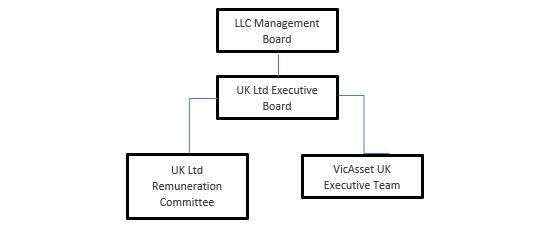

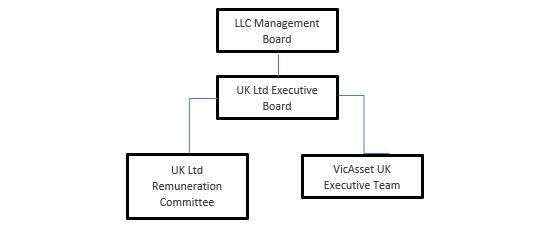

VicAsset has adopted a risk management governance structure comprising of itself and various management boards to provide review, challenge and oversight of the firm’s risks. The link between the Board and its committees are shown below.

The following Terms of Reference, recommended by the UKCo Executive Board have been approved by the LLC Management Board.

LLC Management Board: provides oversight of VicAsset.

VicAsset Advisors UK Limited Executive Board: main governing body for VicAsset

- Key board activities/ responsibilities/standing agenda items:

- To prepare and review VicAsset strategy.

- To review and approve VicAsset budget prior to submission to the LLC Management Board.

- To review actual performance versus budget.

- To review forecast performance and potential future cash calls.

- To review the latest VicAsset Risk Management Pack and elevate any key risks to the LLC Management Board.

- Frequency of meetings:

- Quarterly or on ad-hoc basis where key decisions are required in a timely manner.

- Membership:

- 4 members

Other committees:

- UK Remuneration Committee

- VicAsset Executive Team

2.1.2. Diversity

VicAsset has not adopted a formal approach to diversity. However, the Board considers that the diversity of the Limited Board and other committees is appropriate given the nature, scope and complexity of the business model.

2.1.3. Directorships

The following Directors of VicAsset Advisors UK Limited have held office in executive and non-executive functions throughout the financial year ending 31 December 2023:

- James Adams

- Benjamin Bianchi

- Charles Blackburn

- Christopher de Mestre

- Giles Horridge

- Neil Sargent

Other Directorships:

- Benjamin Bianchi

- Ppbrg GP Ltd

- Oaktree Capital Management (UK) LLP – Member

- Deutsche Euroshop Supervisory Board – Board Member

- Charles Blackburn

- Arsenale S.p.A.

- Devone S.p.A.

- Arsenale Minerva S.r.l.

- Arsenale Hospitality S.r.l

- Arsenale Express S.p.A.

- Arsenale Spineto S.r.l.

- Arsenale Cortina S.r.l.

- Dev Maratea S.r.l.

- CFI – Cantieri Ferroviari Italiani S.r.l.

- AM S.p.A.

- Hotel Invest Italiana Real Estate – H.I.I.R.E. S.r.l.

- Saturn Holdco S.A.

- VicAsset Advisors UK Limited

- Castello SGR

- Lioncor Developments Limited

- 13 Regents Park Road Management Company Limited

- Oaktree Capital Management (UK) LLP – LLP Member

- Pure Data Centres Group Limited

- Christopher de Mestre

- Merestone Farm Limited

- Merestone Farm Limited

- Giles Horridge

- HGR Investments (Bidco) Limited

- HGR Investments (Holdco) Limited

- BTR CQ Limited

- BTR Midco Limited

- BTR Holdco Limited

- BTR Farnham Limited

- BTR Walton Limited

- BTR Residential Limited

- Seniorcare UK Propco Limited

- Seniorcare UK Propco Sub Limited

- Seniorcare UK Propco Holdco Limited

- Pure Data Centres Group Limited

- BTR Bow Square Limited

- Cinderella Investments Limited

- Neil Sargent

- Modern Living Developments (General Partner) Limited

- Modern Living Developments (General Partner) 2 Limited

3. Risk Management

3.1 Approach to Risk Management

VicAsset maintains a Risk Management Policy which it has designed and adopted to ensure that it is able to identify, mitigate and manage risks to which it is, or may be, exposed. This defines risk as the potential that a threat will result in an event occurring which leads to a loss or a failure of the Firm to achieve its objectives. The Policy sets out the firm’s approach to managing these risks. Where possible, VicAsset UK will seek to control and monitor risks to ensure that they remain within the Firm’s stated risk appetites.

3.2 Roles and Responsibilities

Ultimate responsibility for risk management rests with VicAsset UK’s Board. The Compliance Officer is responsible for the risk management function and maintenance of risk management policy. Individual risks are owned across the business. Each risk owner is responsible for the identification, assessment and management of the risks which relate to the process and activities which they oversee. Each Department Head will assume the role of risk owner in respect of their area of responsibility. The Compliance Officer is responsible for providing oversight in respect of this process. This includes ensuring that risk owners periodically assess the risks they own, that this assessment has been documented and that it remains reasonable and reflective of the firm’s current risk profile (i.e. based on the historic risk events faced by the firm). The Compliance Officer is responsible for raising risk-related matters at the Board for discussion, in particular the results of any ongoing monitoring which may indicate that the firm’s risk exposure is increasing.

3.3 Risk Appetite

VicAsset has a low appetite in respect of all risks. The Firm’s business model and activities are non-complex and the delivery of the firm’s strategy is not considered to be dependent on the risk seeking activity. The firm acts as a sub-advisor to a number of Oaktree managed funds but does not have decision making power in respect of investments, and nor does the firm hold client money or assets.

3.4 Key Prudential Risks

- Own funds requirement risk: as the Firm operates on a cost-plus revenue model, as well as maintaining a healthy surplus of regulatory capital in excess of its requirements, the Board considers that the own funds requirement risk is extremely low. The Compliance Officer monitors the capital surplus on at least a monthly basis.

- Concentration risk: the main concentration risk arises from the Firm’s business model which is providing investment services exclusively to one client, Oaktree Capital Management (UK) LLP. The main mitigant to this risk is the provision of excellent service on an ongoing basis. Otherwise, the contractual arrangements with Oaktree would allow for the orderly wind-down of the Firm in the event that the relationship was terminated.

- Liquidity risk: the main liquidity risk arises from the potential mismatch between revenue inflows and expense outflows. Managing this risk is the responsibility of the CEO, Giles Horridge, who carefully monitors the timings of significant cash movements to ensure that healthy surpluses are maintained.

3.5 Approach to assessing the effectiveness of the Risk Management Function

The Board of VicAsset has ultimate responsibility for assessing the effectiveness of the Risk Management Function. The Compliance Officer reviews and updates the Risk Management Policy on at least an annual basis to ensure that the risk management function remains relevant and accurately reflects the Firm’s approach to managing risk

4. Own Funds

4.1 Composition of Own Funds

Composition of Regulatory Own Funds

Item

Amount {GBP thousands}

Source based on reference numbers/letters of the balance sheet in the audited financial statements

1

OWN FUNDS

9,886,188

2

Tier 1 Capital

9,886,188

3

Common Equity Tier 1 Capital

9,886,188

4

Fully paid-up capital instruments

702,001

Note 17

5

Retained earnings

9,184,187

4.2 Reconciliation to audited financial information

Own funds: reconciliation of regulatory own funds to balance sheet in the audited financial statements

£

a

b

c

Balance sheet as in published/audited financial statements

Under regulatory scope of consolidation

Cross reference to template OF1

As at period end

As at period end

Assets - Breakdown by asset classes according to the balance sheet in the audited financial statements

1

Tangible Assets

28,002

N/A

2

Investments

977,947

N/A

3

Debtors

9,385,823

N/A

4

Cash in Bank

6,080,378

N/A

Total Assets

16,472,150

N/A

Liabilities - Breakdown by liability classes according to the balance sheet in the audited financial statements

1

Creditors: amounts falling within one year

5,596,591

N/A

2

Creditors: amounts falling after one year

22,760

N/A

Total Liabilities

5,619,351

N/A

Shareholders' Equity

1

Called up share capital

702,001

N/A

4

2

Profit and loss account

10,150,798

N/A

5

Total Shareholders' equity

10,852,799

N/A

4.3 Main features of the firm’s own funds instruments

Template OF3: Own funds: main features of own instruments issued by the firm

Share capital – allocated, called up and fully paid: 702,001 Ordinary shares of £1.00 each

5. Own Funds Requirement

Requirement

[£’s]

Permanent Minimum Requirement

55,000

Fixed Overhead Requirement

2,551,484

Total K-Factor Requirement

1,130,748

Sum of K-AUM, K-CMH and K-ASA

1,130,748

5.1 Overall Financial Adequacy

VicAssets's three-year financial projections show that it will maintain adequate financial resources throughout the forecast period (1 January 2024 to 31 December 2026). A detailed review of the requirements is shown in the Firm’s ICARA Process Document. The VicAsset Board is satisfied that the firm will meet the overall financial adequacy rule throughout the forecast period and will be able to meet its debts as they fall due.

6. Remuneration

6.1 Qualitative Disclosures

The Firm has implemented a Remuneration Policy which is compliant with the requirements of SYSC 19G within the FCA Handbook. It is committed to maintaining remuneration policies, procedures and practices that are consistent with and promote sound and effective risk management and that are in line with the Firm’s business strategy, objectives and long-term interests.

As a Firm providing investment services to its client, it must ensure that it does not remunerate or assess the performance of staff in a way that conflicts with its duty to act in the best interests of the client. It ensures that clients are treated fairly, and their interests are not impaired by the Firm’s remuneration practices. It also ensures that the remuneration policy does not create any conflict of interest or incentive that may lead to staff favouring their own or the Firm’s interests to the potential detriment of the client.

The Firm has identified certain Material Risk Takers (“MRTs”) whose professional activities have a material impact on the risk profile of the Firm or of the assets that the Firm advises on. These comprise:

- members of the Management Board;

- staff members that have managerial responsibility advising on investments; and

- staff members that have managerial responsibilities for the activities of a control function.

The Firm maintains a Remuneration Committee which oversees the annual award of fixed and variable pay awards.

The criteria used by the Firm for setting fixed versus variable remuneration is as follows:

- Fixed Remuneration: Primarily reflects a staff member’s professional experience and organisational responsibility as set out in their job description and terms of employment.

- Variable Remuneration: Is based on performance and reflects long-term performance, as well as performance above and beyond a staff members job description.

The Firm aims to ensure that there is an appropriate balance between any fixed and variable remuneration and the structure does not favour our interests over those of the client. Further, that the fixed component represents a sufficiently high proportion of the total remuneration to enable the operation of a fully flexible policy on variable remuneration, including the possibility of paying no variable remuneration component.

From time to time, the Firm enters into agreements to award non-standard forms of variable remuneration to MRTs such as sign on bonuses, retention bonuses and severance payments.

6.2 Quantitative Disclosures

During the year to 31 December 2023, VicAsset employed four(4) Senior Managers and a further six (6) non-SMF Material Risk Takers.

Fixed remuneration

Variable renumeration

Total remuneration

Senior Management

613,429

117,593

731,022

Other Material Risk Takers

1,762,856

1,641,375

3,404,231

Other staff

1,574,083

1,445,484

3,019,567

Total

3,590,368

3,204,452

7,154,820

Total amount of guaranteed variable remuneration awarded

Number of Individuals

Senior Management

0

0

Other Material Risk Takers

0

0

Total amount of severance payments awarded

Number of individuals

Senior Management

0

2

Other Material Risk Takers

0

0

Highest severance payment awarded to an individual Material Risk Taker

0

- CloudEstate

Regulatory Disclosures

VicAsset Advisors UK Limited

Public Disclosure (MIFIDPRU 8)

September 2024

1. Introduction and COntext

The Investment Firms Prudential Regime (IFPR) is the FCA’s new prudential regime for MiFID investment firms which aims to streamline and simplify the prudential requirements for UK investment firms. IFPR came into effect on 1st January 2022, and its provisions apply to VicAsset Advisors UK Limited (“VicAsset” or “the Firm”) as an FCA authorised and regulated firm.

The public disclosure requirements of IFPR are set out in MIFIDPRU 8, replacing the previous Pillar 3 requirements under BIPRU 11.

VicAsset is classified as a non-SNI firm given it breaches at least one of the requirements set out in MIFIDPRU 1.2.1 R to qualify as an SNI firm. In this case, the firm has crossed the following threshold:

- Average AUM, as calculated by the methodology set out in MIFIDPRU 4.7.5 R, of greater than £1.2 billion. Note that in the case of VicAsset, this comprises of assets subject to investment advice of an ongoing nature.

VicAsset is required to disclose the following information:

- Governance arrangements (MIFIDPRU 8.3): non-SNI firms are required to disclose certain information including:

- An overview of the firm’s governance arrangements

- The number of directorships held by each member of the governing body (this only applies to directorships of commercial enterprises, charities and directorships of other group entities are excluded).

- A summary of the firm’s policy on promoting diversity in the governing body.

- Whether the firm has established a risk committee

- Own funds (MIFIDPRU 8.4): firms must provide details of their own funds (using the template provided in MIFIDPRU 8 Annex 1R), and a reconciliation of the same information in the firm’s report and accounts (where available).

- Own funds requirements (MIFIDPRU 8.5): firms must disclose details of their own funds requirements including the fixed overhead requirement (FOR) and a breakdown of their K-factor requirements (non-SNI only). All firms are also required to disclose their approach to assessing their compliance with the overall financial adequacy rule (MIFIDPRU 7.4.7R).

- Risk Management (MIFIDPRU 8.2): firms must disclose their risk management objectives and policies in respect of the following categories of risk addressed by:

- MIFIDPRU 4: Own Funds Requirements

- MIFIDPRU 5: Concentration Risk; and

- MIFIDPRU 6: Liquidity

- Remuneration Policy and practices (MIFIDPRU 8.6)

- Provision of quantitative and qualitative disclosures in respect of the firm’s remuneration arrangements

2. GOVERNANCE

2.1 Overview of Governance Arrangements:

2.1.1. VicAsset Boards

VicAsset has adopted a risk management governance structure comprising of itself and various management boards to provide review, challenge and oversight of the firm’s risks. The link between the Board and its committees are shown below.

The following Terms of Reference, recommended by the UKCo Executive Board have been approved by the LLC Management Board.

LLC Management Board: provides oversight of VicAsset.

VicAsset Advisors UK Limited Executive Board: main governing body for VicAsset

- Key board activities/ responsibilities/standing agenda items:

- To prepare and review VicAsset strategy.

- To review and approve VicAsset budget prior to submission to the LLC Management Board.

- To review actual performance versus budget.

- To review forecast performance and potential future cash calls.

- To review the latest VicAsset Risk Management Pack and elevate any key risks to the LLC Management Board.

- Frequency of meetings:

- Quarterly or on ad-hoc basis where key decisions are required in a timely manner.

- Membership:

- 4 members

Other committees:

- UK Remuneration Committee

- VicAsset Executive Team

2.1.2. Diversity

VicAsset has not adopted a formal approach to diversity. However, the Board considers that the diversity of the Limited Board and other committees is appropriate given the nature, scope and complexity of the business model.

2.1.3. Directorships

The following Directors of VicAsset Advisors UK Limited have held office in executive and non-executive functions throughout the financial year ending 31 December 2023:

- James Adams

- Benjamin Bianchi

- Charles Blackburn

- Christopher de Mestre

- Giles Horridge

- Neil Sargent

Other Directorships:

- Benjamin Bianchi

- Ppbrg GP Ltd

- Oaktree Capital Management (UK) LLP – Member

- Deutsche Euroshop Supervisory Board – Board Member

- Charles Blackburn

- Arsenale S.p.A.

- Devone S.p.A.

- Arsenale Minerva S.r.l.

- Arsenale Hospitality S.r.l

- Arsenale Express S.p.A.

- Arsenale Spineto S.r.l.

- Arsenale Cortina S.r.l.

- Dev Maratea S.r.l.

- CFI – Cantieri Ferroviari Italiani S.r.l.

- AM S.p.A.

- Hotel Invest Italiana Real Estate – H.I.I.R.E. S.r.l.

- Saturn Holdco S.A.

- VicAsset Advisors UK Limited

- Castello SGR

- Lioncor Developments Limited

- 13 Regents Park Road Management Company Limited

- Oaktree Capital Management (UK) LLP – LLP Member

- Pure Data Centres Group Limited

- Christopher de Mestre

- Merestone Farm Limited

- Merestone Farm Limited

- Giles Horridge

- HGR Investments (Bidco) Limited

- HGR Investments (Holdco) Limited

- BTR CQ Limited

- BTR Midco Limited

- BTR Holdco Limited

- BTR Farnham Limited

- BTR Walton Limited

- BTR Residential Limited

- Seniorcare UK Propco Limited

- Seniorcare UK Propco Sub Limited

- Seniorcare UK Propco Holdco Limited

- Pure Data Centres Group Limited

- BTR Bow Square Limited

- Cinderella Investments Limited

- Neil Sargent

- Modern Living Developments (General Partner) Limited

- Modern Living Developments (General Partner) 2 Limited

3. Risk Management

3.1 Approach to Risk Management

VicAsset maintains a Risk Management Policy which it has designed and adopted to ensure that it is able to identify, mitigate and manage risks to which it is, or may be, exposed. This defines risk as the potential that a threat will result in an event occurring which leads to a loss or a failure of the Firm to achieve its objectives. The Policy sets out the firm’s approach to managing these risks. Where possible, VicAsset UK will seek to control and monitor risks to ensure that they remain within the Firm’s stated risk appetites.

3.2 Roles and Responsibilities

Ultimate responsibility for risk management rests with VicAsset UK’s Board. The Compliance Officer is responsible for the risk management function and maintenance of risk management policy. Individual risks are owned across the business. Each risk owner is responsible for the identification, assessment and management of the risks which relate to the process and activities which they oversee. Each Department Head will assume the role of risk owner in respect of their area of responsibility. The Compliance Officer is responsible for providing oversight in respect of this process. This includes ensuring that risk owners periodically assess the risks they own, that this assessment has been documented and that it remains reasonable and reflective of the firm’s current risk profile (i.e. based on the historic risk events faced by the firm). The Compliance Officer is responsible for raising risk-related matters at the Board for discussion, in particular the results of any ongoing monitoring which may indicate that the firm’s risk exposure is increasing.

3.3 Risk Appetite

VicAsset has a low appetite in respect of all risks. The Firm’s business model and activities are non-complex and the delivery of the firm’s strategy is not considered to be dependent on the risk seeking activity. The firm acts as a sub-advisor to a number of Oaktree managed funds but does not have decision making power in respect of investments, and nor does the firm hold client money or assets.

3.4 Key Prudential Risks

- Own funds requirement risk: as the Firm operates on a cost-plus revenue model, as well as maintaining a healthy surplus of regulatory capital in excess of its requirements, the Board considers that the own funds requirement risk is extremely low. The Compliance Officer monitors the capital surplus on at least a monthly basis.

- Concentration risk: the main concentration risk arises from the Firm’s business model which is providing investment services exclusively to one client, Oaktree Capital Management (UK) LLP. The main mitigant to this risk is the provision of excellent service on an ongoing basis. Otherwise, the contractual arrangements with Oaktree would allow for the orderly wind-down of the Firm in the event that the relationship was terminated.

- Liquidity risk: the main liquidity risk arises from the potential mismatch between revenue inflows and expense outflows. Managing this risk is the responsibility of the CEO, Giles Horridge, who carefully monitors the timings of significant cash movements to ensure that healthy surpluses are maintained.

3.5 Approach to assessing the effectiveness of the Risk Management Function

The Board of VicAsset has ultimate responsibility for assessing the effectiveness of the Risk Management Function. The Compliance Officer reviews and updates the Risk Management Policy on at least an annual basis to ensure that the risk management function remains relevant and accurately reflects the Firm’s approach to managing risk

4. Own Funds

4.1 Composition of Own Funds

|

|

Composition of Regulatory Own Funds |

||

|

|

Item |

Amount {GBP thousands} |

Source based on reference numbers/letters of the balance sheet in the audited financial statements |

|

1 |

OWN FUNDS |

9,886,188 |

|

|

2 |

Tier 1 Capital |

9,886,188 |

|

|

3 |

Common Equity Tier 1 Capital |

9,886,188 |

|

|

4 |

Fully paid-up capital instruments |

702,001 |

Note 17 |

|

5 |

Retained earnings |

9,184,187 |

|

4.2 Reconciliation to audited financial information

|

Own funds: reconciliation of regulatory own funds to balance sheet in the audited financial statements |

||||

|

|

£ |

a |

b |

c |

|

|

|

Balance sheet as in published/audited financial statements |

Under regulatory scope of consolidation |

Cross reference to template OF1 |

|

|

|

As at period end |

As at period end |

|

|

Assets - Breakdown by asset classes according to the balance sheet in the audited financial statements |

||||

|

1 |

Tangible Assets |

28,002 |

N/A |

|

|

2 |

Investments |

977,947 |

N/A |

|

|

3 |

Debtors |

9,385,823 |

N/A |

|

|

4 |

Cash in Bank |

6,080,378 |

N/A |

|

|

Total Assets |

16,472,150 |

N/A |

|

|

|

Liabilities - Breakdown by liability classes according to the balance sheet in the audited financial statements |

||||

|

1 |

Creditors: amounts falling within one year |

5,596,591 |

N/A |

|

|

2 |

Creditors: amounts falling after one year |

22,760 |

N/A |

|

|

Total Liabilities |

5,619,351 |

N/A |

|

|

|

Shareholders' Equity |

||||

|

1 |

Called up share capital |

702,001 |

N/A |

4 |

|

2 |

Profit and loss account |

10,150,798 |

N/A |

5 |

|

Total Shareholders' equity |

10,852,799 |

N/A |

|

|

4.3 Main features of the firm’s own funds instruments

|

Template OF3: Own funds: main features of own instruments issued by the firm |

|

Share capital – allocated, called up and fully paid: 702,001 Ordinary shares of £1.00 each |

5. Own Funds Requirement

|

Requirement |

[£’s] |

|

Permanent Minimum Requirement |

55,000 |

|

Fixed Overhead Requirement |

2,551,484 |

|

Total K-Factor Requirement |

1,130,748 |

|

Sum of K-AUM, K-CMH and K-ASA |

1,130,748 |

5.1 Overall Financial Adequacy

VicAssets's three-year financial projections show that it will maintain adequate financial resources throughout the forecast period (1 January 2024 to 31 December 2026). A detailed review of the requirements is shown in the Firm’s ICARA Process Document. The VicAsset Board is satisfied that the firm will meet the overall financial adequacy rule throughout the forecast period and will be able to meet its debts as they fall due.

6. Remuneration

6.1 Qualitative Disclosures

The Firm has implemented a Remuneration Policy which is compliant with the requirements of SYSC 19G within the FCA Handbook. It is committed to maintaining remuneration policies, procedures and practices that are consistent with and promote sound and effective risk management and that are in line with the Firm’s business strategy, objectives and long-term interests.

As a Firm providing investment services to its client, it must ensure that it does not remunerate or assess the performance of staff in a way that conflicts with its duty to act in the best interests of the client. It ensures that clients are treated fairly, and their interests are not impaired by the Firm’s remuneration practices. It also ensures that the remuneration policy does not create any conflict of interest or incentive that may lead to staff favouring their own or the Firm’s interests to the potential detriment of the client.

The Firm has identified certain Material Risk Takers (“MRTs”) whose professional activities have a material impact on the risk profile of the Firm or of the assets that the Firm advises on. These comprise:

- members of the Management Board;

- staff members that have managerial responsibility advising on investments; and

- staff members that have managerial responsibilities for the activities of a control function.

The Firm maintains a Remuneration Committee which oversees the annual award of fixed and variable pay awards.

The criteria used by the Firm for setting fixed versus variable remuneration is as follows:

- Fixed Remuneration: Primarily reflects a staff member’s professional experience and organisational responsibility as set out in their job description and terms of employment.

- Variable Remuneration: Is based on performance and reflects long-term performance, as well as performance above and beyond a staff members job description.

The Firm aims to ensure that there is an appropriate balance between any fixed and variable remuneration and the structure does not favour our interests over those of the client. Further, that the fixed component represents a sufficiently high proportion of the total remuneration to enable the operation of a fully flexible policy on variable remuneration, including the possibility of paying no variable remuneration component.

From time to time, the Firm enters into agreements to award non-standard forms of variable remuneration to MRTs such as sign on bonuses, retention bonuses and severance payments.

6.2 Quantitative Disclosures

During the year to 31 December 2023, VicAsset employed four(4) Senior Managers and a further six (6) non-SMF Material Risk Takers.

|

|

Fixed remuneration |

Variable renumeration |

Total remuneration |

|

Senior Management |

613,429 |

117,593 |

731,022 |

|

Other Material Risk Takers |

1,762,856 |

1,641,375 |

3,404,231 |

|

Other staff |

1,574,083 |

1,445,484 |

3,019,567 |

|

Total |

3,590,368 |

3,204,452 |

7,154,820 |

|

|

Total amount of guaranteed variable remuneration awarded |

Number of Individuals |

|

Senior Management |

0 |

0 |

|

Other Material Risk Takers |

0 |

0 |

|

|

Total amount of severance payments awarded |

Number of individuals |

|

Senior Management |

0 |

2 |

|

Other Material Risk Takers |

0 |

0 |

|

Highest severance payment awarded to an individual Material Risk Taker |

0 |

Victoria Asset Management is authorised and regulated by the Financial Conduct Authority.